Step 1

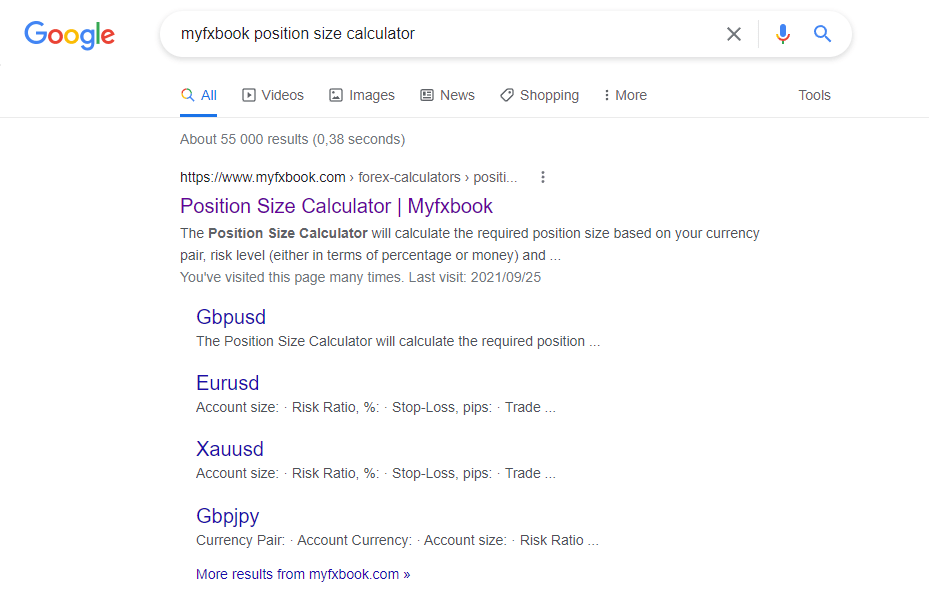

Go to Google and search for “Myfxbook Position Size Calculator”.

Click on the “myfxbook link”, which is usually the first link.

Step 2

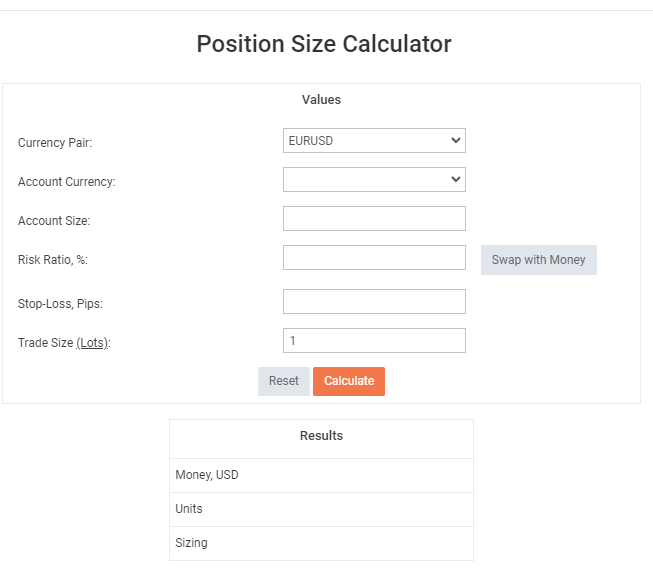

This is what the position calculator will look like.

You will have to provide the position calculator with all the relevant information about your position. You will need to provide your account size, the currency pair, the ratio of your account that you are willing to risk (as a percentage e.g 5%), the size of your stop loss in Pips. After that you’ll press the “Calculate” button then the calculator will provide the correct lot size that you need to use on this position. The calculator ensures that you do not lose more than what you are willing to lose no matter what happens.

Stop Loss Vs Lot Size

You will notice that if you were to change the input you inserted on the stop loss input box, the output lot size also adjusts to the change. So if you could double the size of the stop loss, the output lot size will be halved and vice versa. So basically this calculator will make sure that you use the correct lot size. In Addition, the calculator ensures that if the price of the currency pair moves against you, you will only lose a percentage of your account. This is the percentage that you inserted into the calculator (e.g 5%).

The importance of Risk Management

Risk management is a strategy that a trader implements to ensure that the risk involved with taking a trade is well defined before taking the trade. This means that every trader has his own amount (as a percentage of his trading capital) that he is willing to risk on a single trade. For example, at Forex Made Simple, we encourage beginner traders to risk only 1% of their trading capital in a single trade. This ensures that you do not lose a large portion of your trading capital in a single trade.

Benefits of Applying Risk Management

Besides eliminating the risk of losing all your trading capital at once, proper risk management has a lot of positive effects on your psychology as a trader. Risking a large portion of your trading capital will most definitely mess up your emotions. This will lead to emotional trading which is the fastest way to lose your trading capital. So make sure you keep your risk low so that your emotions don’t get involved in your trades.

![Operations Production Management Internship [Engineering]](https://greatfuture.co.za/wp-content/uploads/2025/03/OIP-8.jpeg)

Great write up.. Keep writing

Great write up.. Keep writing

Great write up.. Keep writing